All Categories

Featured

Table of Contents

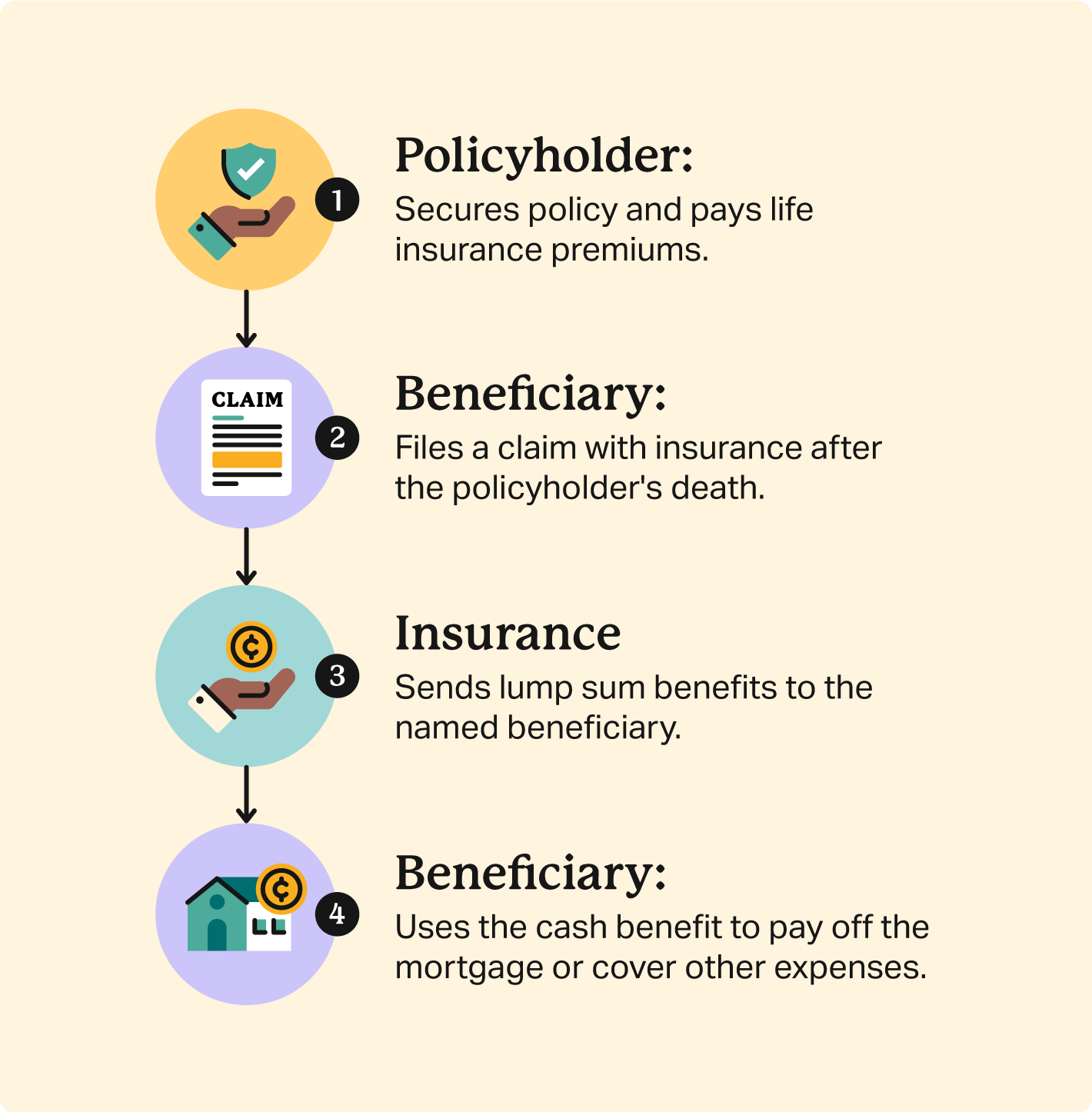

Term life insurance policy might be much better than home mortgage life insurance policy as it can cover home loans and various other expenses. Compare life insurance online in mins with Everyday Life Insurance. Home mortgage life insurance, also recognized as, home loan protection insurance policy, is marketed to house owners as a way to repay their mortgage in situation of fatality.

It seems excellent, it might be much better to get a term life policy with a huge fatality benefit that can cover your home loan for your beneficiary. Home mortgage life insurance policy pays the rest of your mortgage if you pass away during your term. "Home mortgage protection insurance policy is a method to speak about insurance without mentioning passing away," claims Mark Williams, CEO of Brokers International.

Yet unlike a typical term life insurance plan that has the exact same costs, it's rates and the survivor benefit usually lower as your home loan reduces. This insurance is commonly puzzled with exclusive home loan insurance coverage, however they are extremely different ideas. mortgage insurance protection plans. If you have a mortgage and your deposit is much less than the typical 20%, your lending institution will certainly require home mortgage insurance to secure them in case you skip on your home mortgage repayments

Williams claimed a person can name a spouse as the recipient on a home loan defense insurance plan. The partner will get the money and can pick whether to settle the home loan or sell the home. If a person has mortgage life insurance and a term life policy with the spouse as the beneficiary on both, then it can be a double windfall.

Lowering term insurance coverage is the more typical kind of mortgage life insurance policy. With this policy, your insurance policy premiums and protections lower as your mortgage amount reduces. Level term insurance coverage supplies a set death benefit with the period of your home loan. This kind of home mortgage life insurance coverage would certainly appropriate for an insurance holder with an interest-only mortgage where the consumer just pays the rate of interest for a specific amount of time.

Can You Buy Mortgage Insurance

Home loan life insurance additionally requires no medical examinations or waiting periods. If you die with an exceptional mortgage, mortgage life insurance policy pays the rest of the funding directly to the loan provider. Subsequently, your enjoyed ones don't need to manage the financial problem of repaying the home loan alone and can concentrate on grieving your loss.

Your home mortgage life insurance policy policy is based on your mortgage quantity, so the details will vary relying on the price of your home loan. Its rates reduce as your home loan decreases, however costs are generally more pricey than a standard term life plan - insurance to cover mortgage. When choosing your survivor benefit amount for term life insurance policy, the guideline is to select 10 times your annual earnings to cover the home loan, education for dependents, and other costs if you die

Your home loan life insurance policy policy ends when your home loan is repaid. If you pay off your home mortgage before you pass away, you'll be left without a fatality benefitunless you have various other life insurance coverage. Unlike term life insurance policy, irreversible life insurance policy offers long-lasting coverage. It also features a cash worth component, where a part of your costs is saved or invested, boosting your policy's worth.

No Medical Mortgage Life Insurance

With a whole life plan, you pay a set premium for a guaranteed death advantage. In contrast, an universal life plan enables you to readjust when and just how much you pay in premiums, in turn adjusting your coverage.

Home loan life insurance may be a good choice for house owners with health and wellness conditions, as this coverage gives immediate insurance coverage without the demand for a medical examination. Nevertheless, traditional life insurance may be the very best alternative for the majority of people as it can cover your home loan and your other financial commitments. Plus, it often tends to be more affordable.

Nevertheless, you can additionally name other beneficiaries, such as your partner or kids, and they'll obtain the death benefit. With decreasing term insurance policy, your protection decreases as your mortgage reduces. With degree term insurance, your insurance coverage quantity remains the exact same throughout the term. No, lending institutions do not need mortgage life insurance policy.

Mortgage Protection Insurance Home Loan

One perk of home loan life insurance coverage over a standard term policy is that it generally doesn't need a clinical exam - protection review mortgage. Ronda Lee is an insurance coverage professional covering life, car, home owners, and renters insurance for consumers.

ExperienceAlani is a former insurance other on the Personal Finance Expert group. She's assessed life insurance coverage and animal insurer and has actually composed various explainers on traveling insurance policy, debt, financial obligation, and home insurance coverage. She is passionate concerning demystifying the intricacies of insurance and other personal finance subjects so that viewers have the info they need to make the very best money decisions.

When you get a mortgage to buy your home, you will normally require to secure home loan defense insurance coverage. This is a specific sort of life assurance that is gotten for the term of the mortgage. It pays off the mortgage if you, or somebody you have the home loan with, dies.The lender is legally required to ensure that you have mortgage defense insurance prior to giving you a home loan.

Mortgage Insurance With Critical Illness Cover

If you die without home mortgage insurance policy defense, there will be no insurance coverage to pay off the home mortgage. This implies that the joint owner or your recipients will certainly have to continue paying back the home loan. The demand to get home loan security and the exceptions to this are set-out in Area 126 of the Non-mortgage Consumer Debt Act 1995.

You can obtain: Minimizing term cover: The amount that this policy covers lowers as you pay off your home loan and the plan finishes when the home mortgage is paid off. Your costs does not change, also though the degree of cover reduces. This is one of the most typical and cheapest kind of home loan protection.

If you die prior to your home loan is paid off, the insurance policy company will pay out the initial amount you were guaranteed for. This will certainly settle the mortgage and any type of staying equilibrium will most likely to your estate.: You can include major ailment cover to your mortgage insurance coverage. This suggests your home mortgage will be settled if you are diagnosed with and recoup from a major illness that is covered by your policy.

This is extra expensive than other kinds of cover. Life insurance cover: You can utilize an existing life insurance plan as mortgage security insurance policy. You can only do this if the life insurance policy policy provides enough cover and is not designated to cover one more finance or home mortgage. Home mortgage repayment security insurance is a sort of settlement protection insurance.

What Is The Difference Between Mortgage Protection And Life Insurance

This kind of insurance coverage is normally optional and will commonly cover settlements for year - state regulated mortgage protection plan. You ought to check with your home loan loan provider, insurance coverage broker or insurance provider if you doubt about whether you have home mortgage repayment defense insurance coverage. You ought to likewise check precisely what it covers and make sure that it matches your scenario

With a home loan life insurance policy, your beneficiary is your home loan loan provider. This implies that the money from the advantage payout goes directly to your mortgage lender.

Mortgage Insurance Job

Obtaining a home loan is among the biggest responsibilities that adults face. Dropping behind on home loan settlements can bring about paying more passion fees, late costs, foreclosure process and even shedding your house. Home loan defense insurance policy (MPI) is one method to protect your household and financial investment in situation the unthinkable happens.

It is particularly valuable to individuals with costly home mortgages that their dependents couldn't cover if they passed away. The essential difference between home mortgage defense insurance (MPI) and life insurance policy hinges on their coverage and flexibility. MPI is particularly designed to pay off your home loan balance straight to the loan provider if you pass away, while life insurance policy provides a broader fatality benefit that your beneficiaries can make use of for any kind of economic demands, such as home loan repayments, living expenses, and financial debt.

Latest Posts

Final Expenses

Burial Life Insurance Companies

Funeral Insurance Ny